Take Control of Your Future

Having A Financial Plan Makes All The Difference

We work with individuals, families, and business owners who desire to grow and protect their wealth through customized financial plans and investment portfolios.

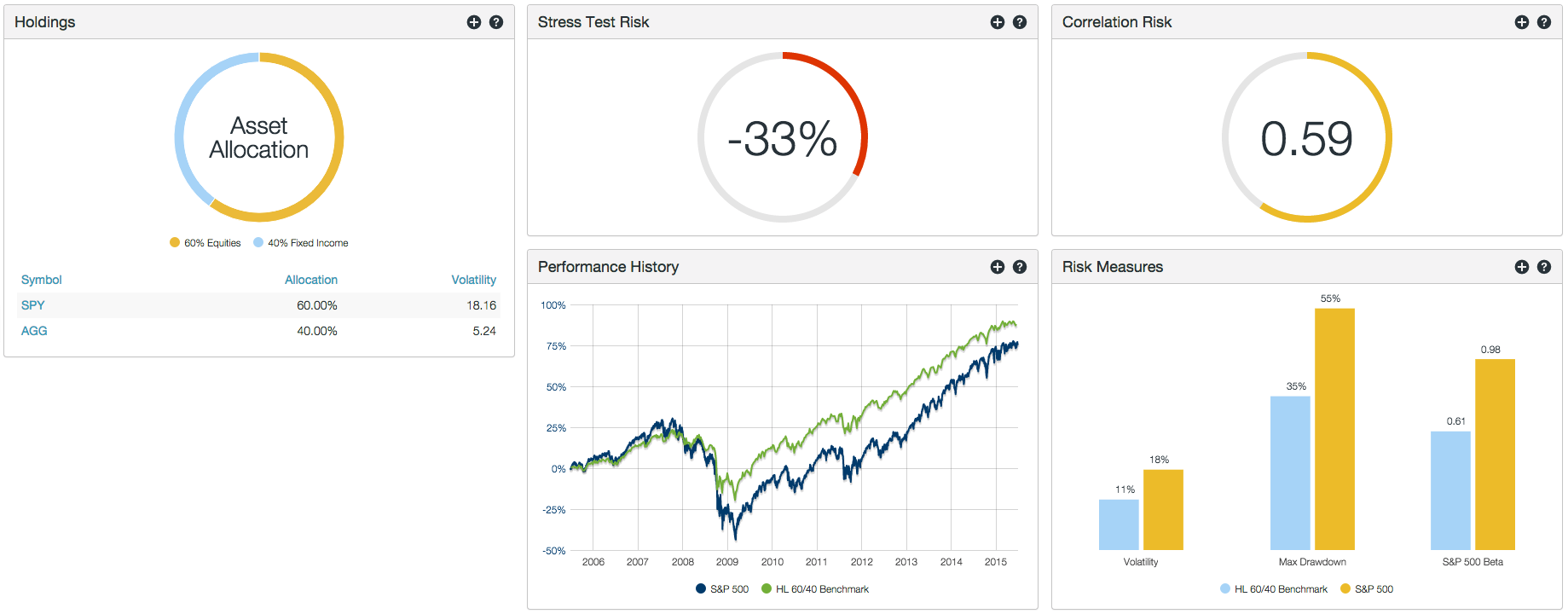

How much risk is in your portfolio?

Portfolio Analysis

Portfolio Analysis

For a limited time we're offering a no-cost second opinion service. We analyze your current investments and give you an unbiased review.

Our Services

We provide a comprehensive, powerful, and affordable solution for managing your personal financial goals. Our plans include...

Fundamentals

We build personal financial statements; statement of net worth and statement of cash flows so you know where you are today. We provide a plan to transform your resources into financial wealth.Risk Management

Generally when something bad happens an economic loss soon follows. We analyze current risk exposures and recommend solutions.Investment Management

We build an investment portfolio in-line with your personal financial goals. We do not chase returns or bet on the next hot stock tips.Retirement Planning

We build a plan to help your investments, retirement pension, and social security benefits work together to provide the income needed to meet your retirement income goals.Tax Planning

Taxes impact just about every area of your financial life. We create efficient tax strategies and recommend how to use them within your personal financial plan.Estate Planning

Estate planning is not just for the wealthy. We develop strategies to protect family wishes and interests and recommend how to use them within your personal financial plan.College Planning

How are you saving to pay for your children's education. We can bring the pieces of this puzzle together.Social Security

How you take social security retirement benefits can add or subtract a sizable amount of income. We'll review your options and give you recommendations based on your retirement goals.Who We Work With

Everyone is at a different place. No matter where you are in life's journey, we can help.

Young Professionals

Were you born in mid-60s to late 90's? If so, you're in the accumulation phase of life... and life is busy. Juggling the goals of growing a family, career advancement, and increasing earnings can leave little consideration for your financial future. Temptation to avoid planning in this stage of life is easy but can be costly to achieving long-term success. You have a valuable asset called Human Capital. We can help develop a plan to transform Human Capital into Financial Wealth.

Near or in retirement

Are you getting close to retirement? Are you already in retirement? If so, you're getting close to spending the money you worked hard to save. Heading into or being in retirement has its own challenges. Will you outlive your money. Can you enjoy the same lifestyle you have now in retirement? How much can I spend in retirement. We can provide detailed answers to these question. We can provide a plan to help secure your retirement plans today and into the future.

Business Owners

Owning a business is probably one of the greatest American dreams and it requires your full attention to make it grow. Your company’s retirement plan is a delicate balancing act. We can help establish an efficient, cost-effective plan that's easy to manage. We can help minimize fiduciary related liabilities. We can help empower employees to invest successfully toward retirement. We can help you free up time and energy for doing what you do best... growing your company.

Our Why

It's easy to tell you "what" we do and "how" we do it. But without first telling you "why" we do it, the "what" and "how" have less meaning.

The world is changing but some companies resist change. They're still selling products before offering advice... that’s the cart before the horse. We give you an alternative to the old way of doing things.

You can do this yourself, but there's a trade-off of time and effort. We'll do the work for you... you get to keep your time. Use it to enjoy life.

Life is full of worries and while we cannot make financial problems magically disappear, we can give you a road map to accomplish your financial goals, dreams, and wishes. This can provide peace of mind.

The Importance Of Advice

Weston Wellington, VP, Dimensional Funds shares the importance of independent, objective, advice

Ken French, Professor, Dartmouth College, Director and Consultant, Dimensional Advisors; David Booth, Founder, Chairman and Co-CEO Dimensional Fund Advisors and Eugene Fama, Professor, University of Chicago, Director and Consultant, Dimensional Advisors, and Nobel laureate in Economics discuss the value of financial advice.

David Butler, Head of Global Financial Advisor Services, Dimensional Fund Advisors discusses the importance of a relationship with an advisor