The importance of Financial Planning, how it’s done, and its value to you and your family is generally misunderstood.

The confusion is understandable. Wall Street’s financial machines spend billions communicating their definition of financial advice.

Typical marketing messages from Wall Street equate financial planning to buying a product.

Being sold a product is not financial planning, nor is it financial advice. Your financial advice should come from a well thought out financial plan.

What you should expect from the financial services industry

You should expect more value from the financial services industry than what has been delivered in the past.

Paying high fees to money managers who sell the idea of beating market returns is an antiquated concept. Too many studies prove it is virtually impossible to consistently beat markets. Paying for such a service does not give you consistent results.

Where then can you find value from the financial service industry?

Below we share recent studies measuring the direct value financial planning and financial advice offers you.

Financial planing is not a product, it is a process. The value of financial planning thrives through guidance and is realized through discipline and time.

It tends to have long feedback loops and until now financial planning’s objective values have been difficult to measure.

The following three studies quantify in detail the value of financial planning.

Study No. 1: Vanguard’s Advisor Alpha Research

The first study is “Putting value on your value: Quantifying Vanguard Advisors Alpha” dated March 2014.

Its authors, Francis M. Kinniry Jr., CFA; Colleen M. Jaconetti, CPA, CFP®; Michael A. DiJoseph, CFA; and Yan Zilbering believe advisors add value through relationship oriented services rather than trying to outperform markets.

Their research identifies methods used by advisors that add measurable value.

Keep in mind each investor is different. Any value depends on your unique circumstances; i.e., your investment time horizons, risk tolerances, risk capacities, assets, financial goals, and tax brackets.

The results of Vanguard’s research estimates financial advisors potentially add about 3% in net returns1 for clients when following the financial planning best practices described in their study.

What are these “best practices”?

Vanguard separated the best practices into seven modules:

- Asset allocation

- Cost-effective implementation

- Rebalancing

- Behavioral coaching

- Asset location

- Withdrawal order for client spending from portfolios

- Total return versus income investing

1. Asset Allocation

The differences in returns received depend on what you are invested in… the breakdown of those investment pieces is called your asset allocation.

There are several asset classes that make up your asset allocation.

Macro assets classes are; stocks, bonds, and cash.

Within stocks you can buy:

- Domestic (U.S. companies) and international stocks,

- Medium and small cap stocks,

- Growth and value stocks.

With bonds it is similar; you can buy:

- Government bonds and corporate bonds,

- Long-term bonds, intermediate-term bonds, and short-term bonds,

- You can buy low-credit quality and high-credit quality bonds.

Vanguard rates the potential value add of asset allocation as “significant”.

Since each investor has different investment time-horizons, risk tolerances, risk capacities, and financial goals. Vanguard’s research felt it is too unique to put a specific number on asset allocation.

Vanguard does cite a study; ”The Asset Allocation Debate: Provocative Questions, Enduring Realities” by authors Joseph H. Davis, Ph.D., Francis M. Kinniry Jr. CFA, and Glenn Sheay CFA

It is widely accepted that a portfolio’s asset allocation (the percentage of a portfolio invested in various asset classes such as stocks, bonds, and cash investments, according to the investor’s financial situation, risk tolerance, and time horizon) is the most important determinant of the return variability and long-term performance of a broadly diversified portfolio that engages in limited market-timing.

It is important to build your asset allocation based on your specific risk tolerance, risk capacity, time-horizon, and financial goals.

We align our client’s asset allocation to their personal financial goals and risk metrics.

2. Cost-effective implementation

Cost-effective implementation is simply choosing lower cost mutual funds.

Some stock and bond funds cost as much as 1.5% annually, some even more. What are you paying?

Using lower cost funds adds to your wealth over time. Reducing investment costs has nothing to do with market performance. The more you save the more you keep… regardless of how the markets are performing.

Vanguard’s study estimates the value added to investors for implementing a cost-effective investment strategy is 0.45% annually.

Vanguard calculated the average investor pays 0.61% for a stock mutual fund and 0.47% for a bond fund.

The lowest priced funds costs 0.15% for stock funds and 0.12% for bond funds.

The savings range is 0.35% to 0.46% depending on asset allocation of any given portfolio. These may seem like small numbers. However, when compounding small percentages over long time periods it adds up.

Depending on your account size, saving even small amounts in fees can add ten-of-thousands, and even hundreds-of-thousands, of dollars to your lifetime wealth.

We use this strategy for our clients. We seek to lower costs where possible… adding value to your wealth.

3. Rebalancing

Over time your portfolio will “drift” from its original allocation. When stocks outperform bonds you end up with a higher percentage of your money in stocks or vice versa.

Rebalancing brings your portfolio back to its intended allocation.

Two things happen when you rebalance; 1) you move risk out of the portfolio, and 2) you tend to sell high and buy low.

Vanguard’s research illustrates just how far a portfolio can drift from its original allocation.

If you started with a 60% stock and a 40% bond portfolio in 1960 and never rebalance your portfolio through the years up to 2013; you would have experienced similar risk adjusted returns as an 80% stock and a 20% bond portfolio.

Having more stocks than bond increases a portfolio’s volatility; i.e., how much it moves up and down.

Drifting so far off of your original allocation will catch you off guard when markets become volatile (as they always do). You would experience larger swings in account values.

Rebalancing moves asset from better performing positions to worse performing positions.

This feels counter intuitive. Why sell the overachievers to only buy underachievers?

It is called reversion to the mean. What goes up must come down and vice versa.

Rebalancing your portfolio in a disciplined and systematic way, either in a bull or bear market, typically allows you to sell high and buy low.

Vanguard calculated up to a 0.35% value to investors when annually rebalancing a 60% stock and 40% bond portfolio compared to the same portfolio that is not rebalanced and allowed to drift from its original allocation.

Keep in mind, rebalancing is about managing risk in your investments. In Vanguard’s words “… the goal of rebalancing is to minimize risk, not maximize returns.”

We use this strategy to add value and manage risk in our clients portfolios.

4. Behavior

Emotional investing is destructive to wealth accumulation. Maintaining a disciplined and long-term approach proves time and time again to be a better decision.

We are emotional by nature and emotion can take control at any point when investing.

Emotions tend to present themselves as irrational choices and leads us to decisions that destroy more wealth as opposed to saving it or creating it.

The very dilemma you try to avoid is created by poor “emotional” investment decisions.

In a different study, Vanguard compared the five year performance of 58,168 self-directed IRA investment accounts that ended in December of 20122.

The time period encapsulates one of the most turbulent investment periods since the great depression, 2007 through 2012.

The self directed investor’s results were compared to portfolios that did not change their target allocations through the same time period.

What did Vanguard’s study reveal?

The “average” investor who made even one exchange over the entire five-year period through 2012 trailed the applicable Vanguard target-date fund benchmark by 150 bps. Investors who refrained from such activity lagged the benchmark by only 19 bps.

Investors who moved money between funds, or into other funds, trying to time the market ended up much worse than if they had stayed the course.

Vanguard also compared individual investor behavior in mutual funds to that of the mutual fund performance itself. The study lasted ten years and ended in December of 2013.

During this time period Vanguard measured individual’s investment performance using internal rates of returns compared to a mutual fund’s time weighted returns.

Internal rates of return account for cash flows (money moving in and out). Time weighted returns measure performance from one time period to the next.

Individual investors underperformed the time weighted performance of the same mutual funds they invested their money in.

Why? When mutual funds perform better they attract investor’s cash; i.e., the investor is buying high. When markets move down investors tend to cash out of mutual funds; i.e., selling low. Buying high and selling low creates poor investment returns.

This was true no matter the cap weighting; i.e., large cap, mid cap, or small cap. Or the style category; i.e., value, blend, or growth. It made no difference whether it was a conservative allocation or a moderate allocation.

Vanguard calculates the potential value add of managing emotions when investing to as much as 1.5%.

Other research and academic studies also conclude the value of managing your emotions when investing can add between 1% and 2% in net returns.

Investing is emotional. We understand the concerns clients deal with when markets go down. We bring objectivity to an emotional time making sense of your investment risks and helping you through the uncertainty.

5. Asset Location

Asset location is not to be confused with asset allocation. Asset location deals with implementing strategies that take advantage of our U.S. tax code.

Different types of accounts have different tax liabilities.

Different types of investments are taxed at different rates.

The types of accounts

Tax-advantaged accounts; e.g., 401k’s, IRA’s, etc., are taxed at ordinary income tax rates for every dollar you withdraw (with the exception of after tax contributions). They do not enjoy the privilege of lower long-term capital gains tax rates.

Other tax-advantage account are exempt from taxation as long as certain IRS rules are met; e.g., Roth IRA, Coverdale ESA, and 529 plans.

Taxable accounts have both ordinary income tax rates as well as capital gains tax rates.

The type of investments

Stocks have capital gains, non-qualified dividends, and qualified dividends.

Bonds are generally taxed at ordinary income tax rates. Bonds have capital gains and losses, but only if sold before maturity in the secondary markets.

Municipal bonds are tax exempt at the Federal level, and in some cases, the State level.

Mutual funds get even more complex when it comes to taxes. Some funds buy and sell most of their holdings within a year (this is referred to as the funds turnover).

A higher turnover equals a greater tax liability when mutual funds are held in taxable accounts.

You can end up with a wide range of tax liabilities depending on the type of investments held between different account types. Asset location works to create tax efficiencies so you can keep more of your money.

Vanguard calculates the potential value add of asset location strategies from 0% to 0.75%. Its value depends on the breakdown of asset between taxable accounts and tax-advantage accounts.

The majority of the benefits occur when the taxable and tax-advantaged accounts are roughly equal in size, the target allocation is in a balanced portfolio, and the investor is in a high marginal tax bracket. If an investor has all of his or her assets in one account type (that is, all taxable or all tax-advantaged), the value of asset location is 0 bps.

Estate Planning

Another value add happens in Estate Planning. Tax efficient strategies can position assets where beneficiaries will receive a step-up in cost basis, thus eliminating a large tax liability.

We develop tax efficient strategies for our clients. How effective this strategy becomes depends on each investor’s mix of account types and sizes.

6. Account withdrawal order for spending in retirement

We get asked this question often. People want to know which account to spend from first.

No matter the tax benefits, each person is different and each plan recommendations are based on your unique circumstances and personal financial goals.

Withdrawal order of spending examines what types of accounts you have; e.g., taxable and tax-advantage, and determines which account you should pull money from first in order to receive the greatest lifetime rates-of-returns.

Depending on your specific breakdown of assets between taxable and tax-advantaged accounts, Vanguard calculates as much as 0.70% of value can be added.

The greatest benefits occur when the taxable and tax-advantaged accounts are roughly equal in size and the investor is in a high marginal tax bracket. If an investor has all of his or her assets in one account type (that is, all taxable or all tax-advantaged), or an investor is not currently spending from the portfolio, the value of the withdrawal order is 0 bps.

We analyze the types of accounts you have and make recommendation where to withdraw from first for retirement income and/or when lump-sum amounts are needed for special purchases such as new automobiles, homes, etc. to help lower the tax burden from your investments.

7. Total return versus income investing

Total return investing takes into consideration both components of returns; income generated through stock dividends and bond coupon rates, and capital appreciations.

Income-only strategies focus on the “income” generated by each investment.

Income-only strategies include chasing higher yields using longer-term bonds or lower credit quality bonds, or buying concentrated positions in dividend centric stocks.

Chasing high yields through the purchase of longer-term bonds increases “duration”. Duration measures the price sensitivity of bonds when interest rates change. High duration bonds are more volatile than short duration bonds.

Chasing high yields through the purchase of lower credit quality bonds creates a “credit risk” for the investor. Lower credit quality bonds have higher default rates. Lower credit quality bonds are “junk bonds” and/or “high yield” bonds.

Shifting investments towards dividend centric stocks in hopes of achieving higher income leaves you exposed to greater risks and volatility. Stocks are stocks and will act like stocks. You increase your volatility when you own more stocks.

When markets become volatile you will regret the decision to concentrate investments to a higher than needed stock allocation.

The total return approach has benefits.

- You can remain better diversified in a total-return approach. Based on your risk metrics you should invest in an stock/bond allocation right for you.

- You can control tax-efficiencies better in a total-return approach. The tax-efficiencies depend on the breakdown of assets you have in taxable and tax-advantaged accounts.

- A total-return approach can extend the lifetime of your investment portfolio based on the factors already mentioned.

Each individual investor is unique. The desired level of spending and breakdown of their portfolio of holdings creates different outcomes. This makes it difficult for Vanguard to estimate an exact value.

We develop an investment approach for our clients that manages risks while creating a sustainable level of income for life.

Study No. 2: Alpha, Beta, and Now Gamma

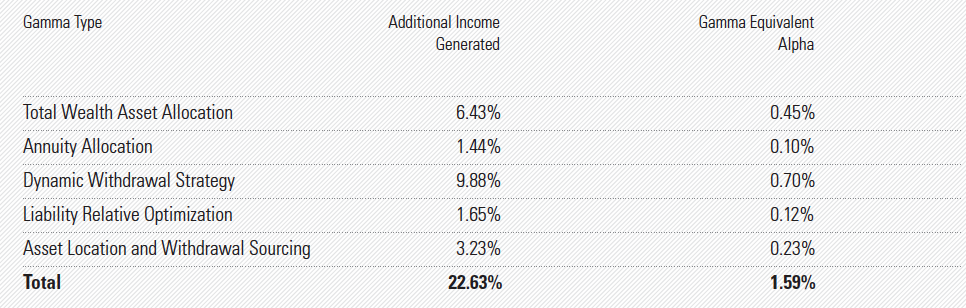

The Alpha, Beta, and now Gamma study measures the value added to retirement income by using financial planning techniques.

The authors David Blanchett, CFA, CFP® and Paul Kaplan, Ph.D., CFA of Morningstar present the concept “Gamma” to quantify the additional value received by individual investors when making more intelligent financial planning decisions.

Blanchett and Kaplan estimates

a retiree can expect to generate 22.6% more in certainty-equivalent income using a Gamma-Efficient retirement income strategy when compared to our base scenario, which assumes a 4% initial portfolio withdrawal where the withdrawal amount is subsequently increased by inflation and a 20% equity allocation portfolio.

This is the same as receiving an annual return increase of 1.59% and is the study’s calculation of the Gamma equivalent alpha.

These financial planning techniques can be achieved by anyone following an efficient financial planning strategy3.

Five financial planning techniques are used; 1) Locating assets in the most tax-efficient accounts, and withdrawing money from account in a tax-efficient sequence; 2) Creating an asset allocation based on financial capital and human capital; 3) The use of guaranteed income products to hedge longevity risk, 4) Using a dynamic withdrawal strategy that accounts for market performances during retirement; and 5) Optimizing an investment portfolio for specific risks retirees face.

The results of the study.

Results are based on models and subject to error. The authors feel their results are strong enough to highlight the differences achieved by using intelligent financial planning decisions compared to the base scenario.

The results are compelling. Retirees should consider the benefits of following these techniques.

The results are compelling. Retirees should consider the benefits of following these techniques.

As mentioned above we consider these factors when building retirement plans for our clients.

Study No. 3: Zeta

The concept of Zeta is the last study we will review. It’s authors John E. Grable, Ph.D., CFP® and Swarn Chatterjee, Ph.D. set out to quantify the value of financial advice as a means for managing total wealth.

The concept of Zeta specifically measures the ability of financial advice to manage wealth volatility over time.

The study’s analysis is based on the following:

1) Financial advisors who follow the planning process have a goal to manage a client’s total financial wealth rather than a specific aspect of wealth; 2) a facet of financial advice value comes from reducing wealth volatility overtime; and 3) the value of financial advice can be quantified into a Zeta estimate.

To test the hypothesis that financial advice adds value by minimizing wealth volatility over time, Grable and Chatterjee measured the total wealth changes of respondents between 2007 and 2009.

To measure wealth for the 2007 and 2009 time periods respondents were asked a simple question…

“Suppose you were to sell all of your major possessions (including your home), turn all of your investments and other assets into cash, and pay all your debts. How much would you have left?”

In addition, respondents were separated into two groups… those who said they had met with an advisor in 2005 and those who had not.

It is important to note the time period used for respondents who met with an advisor in 2005 is two years before the 2007 recession began.

This fact helps determine if the financial advice rendered in 2005 actually benefited those who received it when testing wealth between 2007 and 2009.

Results

…those who reported using the services of a financial advisor did 3.31% better over the period with less dispersion from the respective average.

The data shows the advice of financial advisors did help reduce wealth volatility during one of the most turbulent economic episode since the Great Depression.

This is not to say those who met with a financial advisor in 2005 did not lose wealth over the time period analyzed. It does tell us they lost less wealth than those who did not meet with a financial advisor in 2005.

Another calculation was performed to determine if the performances of those who met with an financial advisor did better when adjusting for risk as compared to those who did not meet with a financial advisor.

Here are the results…

…respondents who had met with a financial advisor not only did nominally better, they also did so in a risk-adjusted manner. The cumulative performance advantage offered by financial advisors in reducing wealth volatility was more than 6 percent during the period.

This is why financial planning is important to you

These three studies demonstrate the power of financial planning.

Financial planning puts the client’s interests first.

Recommendations only come after after a thorough analysis of your current and future financial goals are completed.

Financial planning is important to your financial success. It is a blueprint that improves your current financial lifestyle as well as builds your future financial lifestyle.

We build comprehensive financial plans that take into account your personal goals, your current and future resources, and your risk metrics.

Find out today how a financial plan will help you.

Footnotes

1. The 3% net returns should not be expected annually. The value of advice is intermittent throughout the years. Some years are higher, some lower; but on average, Vanguard’s research claims 3% annualized value is added over an investors lifetime when using these financial planning strategies.

2. Most Vanguard IRA® investors shot par by staying the course: 2008–2012

3. Alpha, Beta, and Now… Gamma pg 2