You're troubled with pain so you get a checkup. You're told "everything is okay" but the pain persists. Would you leave it at that... or would you seek a second opinion?

Think about that scenario in the context of seeing a financial professional instead of a medical professional. It's important to know how financially healthy you are.

Maybe it’s time for a financial checkup or a second opinion. You may have a financial condition that will sneak up on you and cause problems down the road if you don’t deal with it today.

Getting a second opinion will not change what the market does.

It will give you insights why your investments do what they do. It will let you know what, if any, changes are needed and why you should make changes.

Give us the opportunity to analyze your investment portfolio. We'll give you answers about the strengths, weaknesses, and threats in your investments. We'll point out opportunities where you can adjust your portfolio to better fit your personal financial goals.

All this will be delivered to you in handy no-cost report.

Why are we doing this?

Investment products are baffling and the financial service industry is contradictory.

Our free report answers questions you may not know to ask.

How risky are your investments?

Perception of risk is a funny thing. When markets are doing good risk is typically ignored.

Perception of risk is a funny thing. When markets are doing good risk is typically ignored.

When markets change - as they always will - risk reveals itself and keeps people up at night. Not fun.

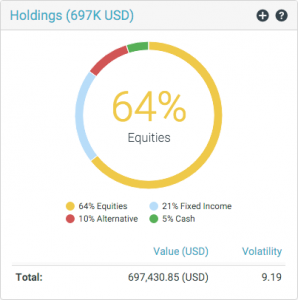

We review the blend of your investments - investment blend is called asset allocation. We show the different asset classes you own, how much of each class you own, and how your asset allocation reacts to different market conditions.

We provide tips to improve your asset allocation.

We provide a "stress test" as part of our free report.

News provides helpful information about current events but it makes for terrible financial advice.

News is one-third information and two-thirds entertainment and networks never fail to sensationalize the story for their benefit.

We use "big data" to measure relationships between your investments and the economy.

We show how current events affect your investments.

What happens when…

…the price of oil rises or the dollar falls against other currencies?

…if unemployment goes up or retail sales fall?

…plus many other scenarios.

We show you the potential downsides and upsides that economic events have on your investments. We give tips to reduce potential investment risks.

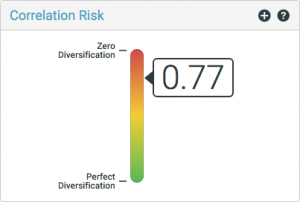

Do all your investments act the same?

It’s called correlation and measures if your investments rise and fall together or separately.

We measure your correlation. We provide tips to improve your correlation diversification. Better diversification plays a role in reducing your investment risk.

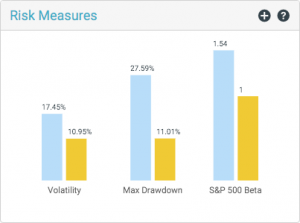

Volatility, max drawdown, and beta... say what?

Think of volatility as a roller coaster ride. Some rollercoasters have small peaks and valleys, others have high peaks and valleys. We show you if you're riding a tame roller coaster or a wild roller coaster.

Max drawdown shows you how low your investments drop compared to indexes or other investments. You can’t avoid market drops. You can lessen the downside depending how you’re investing.

Max drawdown shows you how low your investments drop compared to indexes or other investments. You can’t avoid market drops. You can lessen the downside depending how you’re investing.

Beta is a fancy term for how volatile your investments are when compared to markets as a whole or another mix of investments.

It's good to know your investment’s beta. It explains why your investments are moving higher or lower than what you're hearing in the news.

We score your investments for volatility, max drawdown, and beta in our free report. We give tips to improve your investments in these areas.

Is the advice you're receiving in your best interest?

You would think so. Not true.

Financial professional's responsibility to clients fall into two camps; fiduciary and suitability... and there's a big difference.

Fiduciary responsibility is a legal term requiring the advisor to put the client’s interests first.

A suitability arrangement is nothing more than a sales person selling you a financial product. They must deal with you fairly but they are not required to act in your best interest.

If you're working with a financial professional we let you know if they're responsible to put your interest before their’s or if they’re not obligated to do so.

What are your costs?

Costs matter. Several mutual funds charge high fees but studies show investors receives no value for paying higher fees to mutual fund companies.

Morningstar’s research “The Clear Link Between Fees and Performance” plainly shows the relationship between fees and performance.

…high fees are unlikely to offer above-average performance. Low-fee funds give investors the best chance of success over the long term.

Spend money where it brings value

Several studies show financial planning advice is adding to the bottom line for investors. You can read more about those studies by clicking here.

We show your real costs of investing in our free report. We give you tips to reduce costs.

We make the process of getting your free report simple.

You can call us at 678-392-1155... or schedule a convenient time for us to call you using our "Schedule a call" section below.